Deposits into a first-time home buyer savings account shall not exceed one hundred thousand dollars. First-time homebuyers living in the state of Idaho have a number of mortgage options available when they start shopping for loans such as FHA USDA VA and Conventional loans.

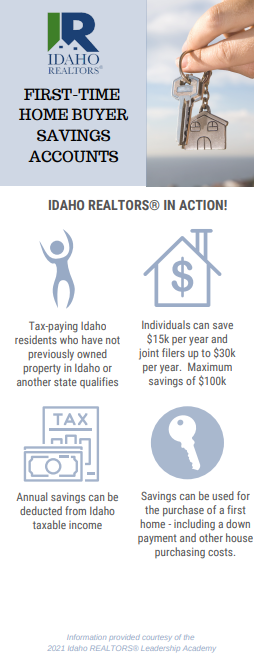

First Time Home Buyer Savings Accounts Idaho Realtors

Check whether your local government sponsors first-time homebuyer programs.

. First-time home buyers can get a conventional home loan with as little as 3 down if the mortgage meets requirements set by Fannie Mae and Freddie Mac. Learn about a cool new program to help you get there. Examples include the use of tax policy or other incentives to reward specific interest groups.

Married couples filing a joint tax return can deduct up to 30000 a year. You will have to pay a 300 fee to your borrower but thats a small price to pay compared to the long-term savings. LoginAsk is here to help you access First Home Buyers Saving Account quickly and handle each specific case you encounter.

Married couples filing a joint tax return can deduct up to 30000 a year. 4 No withdrawals may be made from a first-time home buyer savings account within the first thirty 30 days from the establishment of the account. Tips for Selecting the Right First-Time Homebuyer Program.

Individuals may deduct up to 15000 each year. 1 Does it increase government redistribution of wealth. Thereafter funds held in a first-time home buyer savings account may be withdrawn by the account holder at any time.

Please note that all programs listed on this website may involve a second. 41 rows Savings Accounts benefits NCUA Insured up to 250000 Free Mobile Banking Free Online Banking Free Online eStatements Free automatic transfers Free Credit Score Monitoring See Rates Savings Calculator At Idaho Central we have Savings Account options to help you make insured investments with excellent rates. 0302 Introduced read first time referred to JRA for Printing.

Weve listed federal and Idaho state programs but you might have more options. Savings can be used for a down payment and associated costs. Married couples filing a joint tax return can deduct up to 30000 a year.

Idahoans who set up a First-Time Home Buyer Savings Account at an Idaho financial institution can claim an income tax deduction on their. Learn more about the exemption. Individuals may deduct up to 15000 each year.

Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income tax return. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems. FIRST-TIME HOME BUYERS Adds to existing law to provide for first-time home buyer savings accounts.

Idaho first time home buyers can get 500 to 8000 down payment assistance. The total contributions to a first-time home buyer savings account over the course of its lifetime could be up to 100000. Idaho Housings down payment assistance program eases the upfront financial cost of buying a home and allows you to start building generational wealth sooner.

The Idaho State Tax Commission will be the overseeing entity concerning the rules and forms of this new. First-time home buyers who establish a First-time Home Buyer Savings Account can deduct their account contributions and interest earned from Idaho taxable income. First-Time Home Buyer Savings Accounts or FHSAs help home buyers save for their first home purchases on a tax-advantaged basis.

In total the tax cut from this legislation for Idahoans could be up to 1947528 per year. An Idaho First-Time Home Buyer Savings Account allows you to save for down payment and closing costs if you qualify for a first-time home purchase while reducing the amount of Idaho income tax you owe. This program provides homebuyers up to 10 of the sales price of the home to use towards the down payment andor closing costs.

The Rise Youth and Young Adult Savings account is created specifically for youth ages 0 through 25 years. Money in these accounts can be used for down payments and eligible closing costs including origination fees underwriting fees title and escrow fees and more. Individual states differ on what can and cannot be.

Deposits into a first-time home buyer savings account shall. Young members with this account will earn a special dividend rate until age 26 and account owners who are age 18 and under can learn about saving with the interactive Rise App in CapEd eBanking. In this instance the term First-time home buyers references buyers who have never owned or purchased a home in the state of Idaho.

First Home Buyers Saving Account will sometimes glitch and take you a long time to try different solutions. And if you put at least 20 down you wont. Married couples filing a joint tax return can deduct up to 30000 yearly.

Individuals can deduct up to 15000 each year. HB 483 would allow individuals who are purchasing their first home in Idaho to make up to 15000 in pre-tax contributions to a savings account which they could then put toward the costs of purchasing a single family residence. Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income tax return.

We specialize in First time home buyer programs that help you purchase your first Idaho home. Creates a savings account for first-time home buyers in Idaho. Idahoans who use this program can contribute as little as 05 of the sales price.

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

Idaho First Time Home Buyer Savings Account Lookout Credit Union

Hb 589 Idaho S First Time Home Buyer Savings Account Youtube

First Time Home Buyer Savings Accounts Idaho Realtors

Have You Heard About Idaho S New First Time Home Buyer Savings Account Boise Regional Realtors

0 comments

Post a Comment