Wir helfen Ihnen gerne weiter. Aggressive Debt-to-income affects how much you can borrow.

Marc Bui S Instagram Video 100 000 Salary Is A Milestone Number For Many People It S Actually Quite Simple To Figure Out How Much Ho In 2022 People Salary All Star

What is the monthly payment of the mortgage loan.

. Haben Sie noch Fragen. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. If you have a 20 down payment on a 100000 household salary you can probably comfortably afford a.

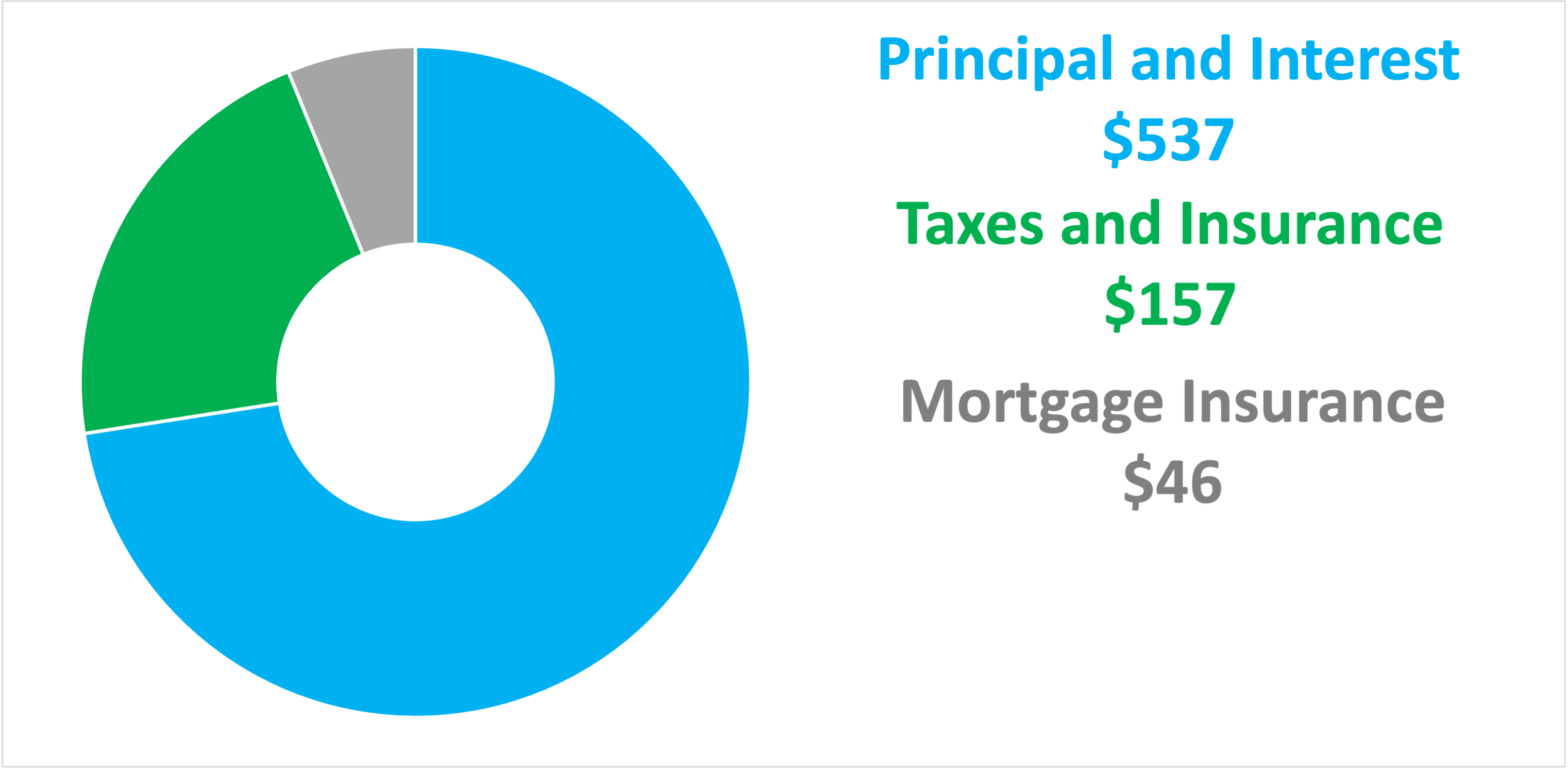

Lets say you have a monthly gross income of 8333 and spend 2200 between your mortgage payment homeowners insurance and property taxes. The front-end debt ratio is also known. Using a home loan of 300000 this would be the results based on a fixed rate of 4241 APR.

You want to keep your debt payments as low as possible. Ad Immobilienfinanzierung leicht gemacht - Hier bekommen Sie das passende Angebot. Most home loans require a down payment of at least 3.

For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000. The 28 percent rule is the most often used guideline for determining whether or not you can purchase a property while there are others. See how much house you can afford with our easy-to-use calculator.

Make sure to consider property taxes home insurance and your other debt payments. If you make 100000 a year you may purchase a house at 558845 not counting taxes and insurance. How much house you can afford on 100k also depends on how much debt you currently have including auto loans student loans credit cards and other loans.

Below is a breakdown of the monthly payment indicating. Know these terms and. Assuming a 4 mortgage rate and a 30000 down payment that.

Use our home affordability calculator with amortization schedule below to receive a more accurate estimate. You can afford 300-500k but just get a decent house that meets your needs. 22008333026 To get your front-end ratio percentage multiply 026 by 100 and you have.

A 500 car payment can reduce your buying power by. Debt-to-income ratio 36 Affordable. You can afford a home up to.

The average cost to build a house is 248000 or between 100 to 155 per square foot depending on your location size of the home and if modern or custom designs are used. Most home loans require a down payment of at least 3. If youre wondering with 100k salary how much house can I afford the 25 rule gives you a mortgage of 250000.

For example if you earned 100000 a year it would be no more than 2333 a month. They are mainly intended for. The most common rule for deciding if you can afford a home is the 28 percent one though many are out there.

Ad Immobilienfinanzierung leicht gemacht - Hier bekommen Sie das passende Angebot. Excellent 720 ZIP code. Your budget and financial situation will determine how much you can afford on a 100k salary but in most cases youll likely qualify for a home worth between 350000 to 500000.

Now keep in mind that that cost must cover everything including. If you earn 100000 per year you may buy a house that costs around 558845 before taxes and insurance are included. The above table gives an estimate of how much house individuals with a 100k annual income in Texas can afford.

New home construction for a 2000 square foot home runs 201000 to 310000 on average. Rule of thumb is that your mortgage should be no more than 3x your annual salary. House Affordability Calculator There are two House Affordability Calculators that can be used to estimate an affordable purchase amount for a house based on either household income-to-debt estimates or fixed monthly budgets.

This is what you can afford in 449484 Your monthly payment 2500 Affordable Stretch Aggressive Your debt-to-income ratio DTI would be 36 meaning 36 of your pretax income would go toward. Wir helfen Ihnen gerne weiter. You should buy a property that wont take anything more than 28 percent of your gross monthly income.

If you take 30 of 100000 you will get 30000. Use this calculator to calculate how expensive of a home you can afford if you have 110k in annual income. But this persons credit score is 700 and they only pay 250 in non-mortgage debts each month.

If you have a 20 down payment on a 100000 household salary you can probably comfortably afford a 560000 condo. Most home loans require a down payment of at least 3. To receive a more exact estimate please use our home affordability calculator with amortization schedule provided below.

Your Front-End Ratio 100 Your Front-End Percentage. Means you could probably afford a home price of up to 500k. This means that if you make 100000 a year you should be able to afford 2500 per month in rent.

Haben Sie noch Fragen. Just like lenders our Affordability Calculator looks at your Debt-to-Income Ratio DTI to determine what home price you can afford. With a salary of 100000 per year how much house can I afford.

In this case to find our housing expense ratio. Equally the lower the interest rate you can get the less youll pay each month against your mortgage as well as over the life of the loan. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances.

How much home can I afford if I make 110000. For instance someone with low credit might only be eligible for a 300000 mortgage while someone with excellent credit might qualify for a 500000 mortgage. Buying a house with a 100K salary and good credit Our second borrower also makes 100k a year.

Another rule of thumb is the 30 rule. Another rule of thumb is the 30 rule.

100k Mortgage Mortgage On 100k Bundle

How Much Mortgage Can I Afford With A 100k Salary Foundation Mortgage

How Much House Can I Get With 100k Income Youtube

Can You Build A Home For Less Than 100k My Alternative House

17 Million Members 100k 5 Star Reviews 100 Free Places To Travel Travel Inspo Adventure Travel

How Much Mortgage Can I Afford With A 100k Salary Foundation Mortgage

0 comments

Post a Comment